Beginning on Jan. 1, 2017, drivers in California will be prohibited from holding their cell phones while they drive. Governor Jerry Brown signed AB 1785 in September, and its effective date is on Jan. 1, 2017. The law prohibits holding a cell phone while driving for any purpose, including checking maps, texting, talking or for any other reason.

Beginning on Jan. 1, 2017, drivers in California will be prohibited from holding their cell phones while they drive. Governor Jerry Brown signed AB 1785 in September, and its effective date is on Jan. 1, 2017. The law prohibits holding a cell phone while driving for any purpose, including checking maps, texting, talking or for any other reason.

What the law allows

The new law is codified at California Vehicle Code Sect. 23123.5. It provides that people may only use their cell phones while they are driving if the phones are mounted on their dashes and are set up for voice activation or hands-free use. Systems that are embedded in the vehicle and installed by the manufacturer are exempted. Emergency personnel who are using their cell phones while they are driving emergency vehicles are also exempt from the law. The first offense of the statute is a fine of $20. Successive violations bring increasing fines.

A recent personal injury case that was heard in Los Angeles Superior Court demonstrates a legal concept that is called the eggshell plaintiff rule as well as the difficulties with proving injuries in minor impact soft tissue cases. People who have received soft tissue injuries such as whiplash injuries or others in accidents that were caused by the negligence of other people might need to get help from an experienced personal injury attorney.

A recent personal injury case that was heard in Los Angeles Superior Court demonstrates a legal concept that is called the eggshell plaintiff rule as well as the difficulties with proving injuries in minor impact soft tissue cases. People who have received soft tissue injuries such as whiplash injuries or others in accidents that were caused by the negligence of other people might need to get help from an experienced personal injury attorney.

A recent California case involving a woman who was injured when she tripped over an unattended ladder in Target demonstrates both the business’s knowledge requirement as well as its duty to remove hazards, keeping the premises reasonably safe. In the case, an 83-year-old woman tripped over the ladder, fracturing her hip.

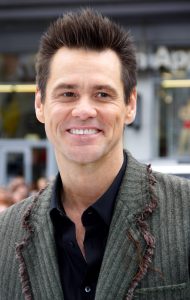

A recent California case involving a woman who was injured when she tripped over an unattended ladder in Target demonstrates both the business’s knowledge requirement as well as its duty to remove hazards, keeping the premises reasonably safe. In the case, an 83-year-old woman tripped over the ladder, fracturing her hip. On September 19, news broke that Jim Carrey is being sued in California for wrongful death by his girlfriend’s estranged husband. Carrey’s girlfriend, Cathriona White, committed suicide in September 2015 by overdosing on several different types of prescription medications. She had married Mark Burton in Las Vegas in 2013 but had dated Carrey for a couple of years afterward without divorcing Burton. Burton is thus her next-of-kin and has made multiple salacious allegations against Carrey in his lawsuit. While a media storm may have ignited, there are multiple reasons why Burton’s case will be very difficult to prove.

On September 19, news broke that Jim Carrey is being sued in California for wrongful death by his girlfriend’s estranged husband. Carrey’s girlfriend, Cathriona White, committed suicide in September 2015 by overdosing on several different types of prescription medications. She had married Mark Burton in Las Vegas in 2013 but had dated Carrey for a couple of years afterward without divorcing Burton. Burton is thus her next-of-kin and has made multiple salacious allegations against Carrey in his lawsuit. While a media storm may have ignited, there are multiple reasons why Burton’s case will be very difficult to prove. A recent construction site accident wrongful death Los Angeles County case and jury verdict illustrate several important topics, including cases in which several parties share liability in causing workplace accidents, workers’ compensation and the liability of third parties in workplace accidents. The case (Rosa Gonzalez, et.al. v. Atlas Construction Supply – L.A. Superior Court Case No. BC 507755) involved a man who was killed while working on a construction site in 2011.

A recent construction site accident wrongful death Los Angeles County case and jury verdict illustrate several important topics, including cases in which several parties share liability in causing workplace accidents, workers’ compensation and the liability of third parties in workplace accidents. The case (Rosa Gonzalez, et.al. v. Atlas Construction Supply – L.A. Superior Court Case No. BC 507755) involved a man who was killed while working on a construction site in 2011. On June 19, 2016 actor Anton Yelchin was killed in a rollaway car accident in the driveway of his Studio City, California home. Mr. Yelchin, most famous for playing Chekov in the new Star Trek movies, had parked his Jeep Cherokee in his driveway, exited the vehicle and walked down the driveway to check for mail in his mailbox. At this same time, the Jeep came out of gear, rolled backwards, and pinned Mr. Yelchin between the Jeep and the large brick mailbox pillar, killing him instantly.

On June 19, 2016 actor Anton Yelchin was killed in a rollaway car accident in the driveway of his Studio City, California home. Mr. Yelchin, most famous for playing Chekov in the new Star Trek movies, had parked his Jeep Cherokee in his driveway, exited the vehicle and walked down the driveway to check for mail in his mailbox. At this same time, the Jeep came out of gear, rolled backwards, and pinned Mr. Yelchin between the Jeep and the large brick mailbox pillar, killing him instantly.